Introduction to the Cash Envelope System

In a world where digital payments and credit cards dominate, many people find it difficult to keep track of their spending. Overspending, mounting debt, and lack of savings are common financial pitfalls. The Cash Envelope System, an old-fashioned yet highly effective budgeting method, offers a simple solution to these problems. By allocating cash for different spending categories and storing it in physical envelopes, this system can help you gain control over your finances, limit unnecessary expenditures, and boost your savings.

This comprehensive guide will walk you through everything you need to know about the envelope budgeting system. From its origins and benefits to practical implementation tips and advanced strategies, youll discover how this approach can transform your financial life.

What Is the Cash Envelope System?

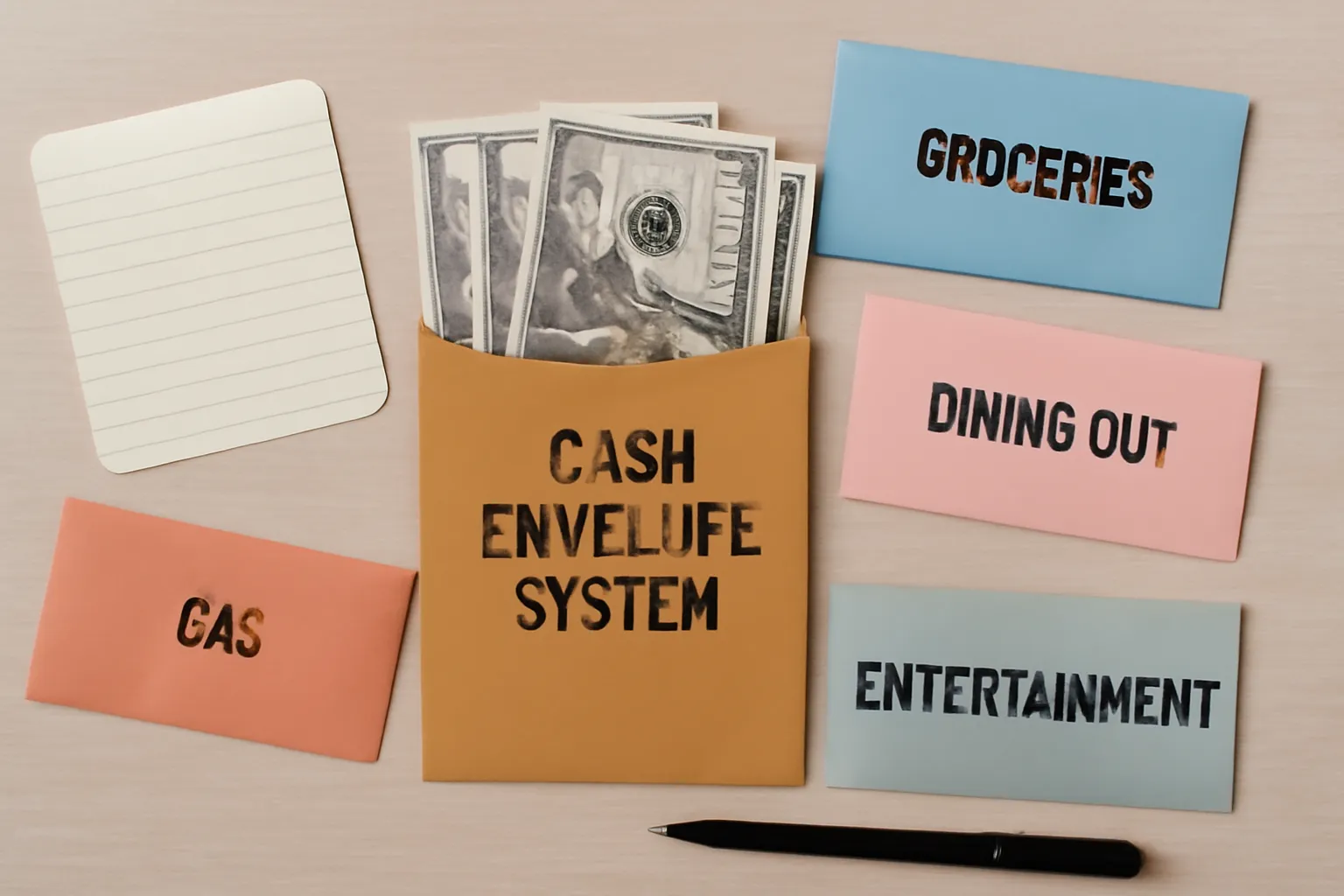

The Cash Envelope System is a zero-based budgeting method that involves dividing your cash into envelopes, each labeled with a specific spending category such as groceries, entertainment, transportation, or dining out. Once an envelope is empty, you are not allowed to spend any more in that category until your next budgeting period, typically the following month.

The system is based on the principle of visualizing your spending. Handling physical cash makes you more aware of your expenditures and helps prevent overspending. By limiting yourself to the amount in each envelope, you develop better spending habits and a greater appreciation for your money.

Origins of the Envelope Budgeting Method

The concept of the envelope budgeting system has been around for decades, even before the rise of modern banking and credit cards. It gained popularity through financial experts like Dave Ramsey, who advocate for cash-based budgeting as a way to escape debt and build wealth. Despite its simplicity, the system remains effective because it leverages basic human psychology: when you physically see your money leaving your hands, you tend to spend less.

Benefits of Using the Cash Envelope System

- Prevents Overspending: By restricting yourself to the cash available in each envelope, you avoid going over budget.

- Improves Financial Awareness: Handling cash makes you more conscious of your spending habits.

- Reduces Debt: Since you only spend what you have, you’re less likely to rely on credit cards and accumulate debt.

- Promotes Saving: Any leftover cash at the end of the month can be added to your savings or put toward financial goals.

- Simple and Low-Tech: No need for complicated apps or spreadsheets; all you need is cash and envelopes.

The cash envelope system is especially useful for those who struggle with impulse purchases or who want to break free from the cycle of living paycheck to paycheck.

How to Set Up the Cash Envelope System

Implementing the envelope cash system is straightforward, but it does require some planning and discipline. Here’s a step-by-step guide to get you started:

Step 1: Determine Your Monthly Income

Start by calculating your total monthly income from all sources. This includes your salary, side hustles, freelance work, or any other consistent income streams.

Step 2: List Your Expenses

Make a list of all your regular monthly expenses. These typically fall into two categories:

- Fixed expenses: Rent, mortgage, utilities, insurance, loan payments.

- Variable expenses: Groceries, gas, dining out, entertainment, clothing, personal care, etc.

The cash envelope method works best for variable expenses, as fixed expenses are often paid electronically.

Step 3: Decide Your Envelope Categories

Choose which spending categories will have their own envelope. Common examples include:

- Groceries

- Transportation (gas, public transit)

- Dining Out

- Entertainment

- Clothing

- Personal Care

- Household Supplies

- Miscellaneous

Tip: Avoid creating too many categories, as this can become overwhelming. Focus on areas where you tend to overspend.

Step 4: Allocate Cash to Each Envelope

Based on your income and expenses, decide how much cash to put in each envelope. Be realistic about your needs and consider reviewing your past spending to set accurate amounts.

For example, if you usually spend $400 per month on groceries, put $400 in your groceries envelope at the beginning of the month.

Step 5: Spend Only from the Envelopes

As you go about your month, spend only from the appropriate envelope for each purchase. If you run out of cash in a particular envelope, you must wait until the next month to spend more in that category.

This discipline is the core of the envelope system for budgeting. It may be challenging at first, but it will help you stay within your budget and avoid unnecessary debt.

Step 6: Track and Adjust

At the end of the month, review how much money is left in each envelope. Did you overspend in any category? Do you have leftover cash? Use this information to adjust your budget for the following month. The envelope cash system is flexible and can be tailored to fit your unique financial situation.

Advanced Strategies for the Cash Envelope Budgeting System

Once you’re comfortable with the basics, consider these advanced techniques to maximize the effectiveness of your envelope system:

Use Sinking Funds

Sinking funds are envelopes set aside for irregular but predictable expenses, such as car repairs, holiday gifts, or annual insurance premiums. By contributing a small amount each month, you can avoid being caught off guard by large bills.

- Create a sinking fund envelope for each anticipated expense.

- Decide how much you need and divide by the number of months until the expense is due.

- Set aside that amount each month in the envelope.

Combine Digital Tools with Cash Envelopes

While the traditional cash envelope budgeting method relies on physical cash, you can adapt it for the digital age. Some people use budgeting apps or spreadsheets to track envelope balances virtually, especially for online purchases or bills paid electronically.

Hybrid envelope systems combine the tactile benefits of cash with the convenience of digital tracking.

Include a Fun Money Envelope

Budgeting shouldn’t feel restrictive. By including a fun money envelope for spontaneous treats or activities, you can enjoy life while still sticking to your financial plan. This reduces the temptation to overspend in other categories.

Challenge Yourself with No-Spend Weeks

Occasionally, challenge yourself to a no-spend week or weekend, where you avoid spending any money outside of essential categories. This exercise helps you become more mindful of your habits and can accelerate your savings.

Involve the Whole Family

If you share finances with a partner or family, involve everyone in the envelope budgeting system. Hold regular meetings to discuss goals, track progress, and adjust as needed. Teaching children about money management using envelopes can set them up for financial success later in life.

Common Challenges and How to Overcome Them

While the cash envelope system is straightforward, it does come with some challenges. Here’s how to address the most common obstacles:

Carrying Large Amounts of Cash

Some people are uncomfortable carrying a lot of cash or worry about theft. To mitigate this:

- Only carry the envelopes you need for the day.

- Keep the rest in a secure place at home.

- Consider using a digital envelope system for non-cash purchases.

Making Online Purchases

The traditional envelope cash system doesn’t account for online shopping. To handle this:

- Have a separate envelope labeled “Online Purchases.”

- When you buy something online, remove the corresponding amount from the envelope and set it aside until you deposit it back into your account.

Dealing with Irregular Income

If your income fluctuates, base your budget on your average monthly earnings or the lowest expected income. Prioritize essential categories and adjust discretionary spending as needed.

Temptation to Borrow from Other Envelopes

It can be tempting to “borrow” cash from one envelope to cover overspending in another. While occasional flexibility is okay, make it a rule to only do this in emergencies. Otherwise, stick to your limits to build discipline.

Cash Envelope System vs. Other Budgeting Methods

There are many ways to budget, including zero-based budgeting, the 50/30/20 rule, and various budgeting apps. Here’s how the envelope method compares:

- Envelope System: Highly visual and tactile, great for those who struggle with overspending.

- Zero-Based Budgeting: Every dollar is assigned a purpose, but spending is tracked digitally.

- 50/30/20 Rule: Simplifies budgeting but may not provide enough detail for some people.

- Apps and Spreadsheets: Convenient for tracking and automation, but less effective for impulse control.

Ultimately, the best method is the one you’ll stick to. Many people find that the cash envelope system provides the accountability and structure they need to succeed.

Tips for Success with the Cash Envelope System

- Be Consistent: Stick to your envelopes every month for best results.

- Review Regularly: Analyze your spending patterns and adjust your categories as your needs change.

- Plan for Emergencies: Keep a small emergency fund separate from your envelopes.

- Reward Yourself: Celebrate milestones, such as paying off debt or reaching a savings goal.

- Stay Flexible: Life changes, and so should your budget. Don’t be afraid to tweak your system as needed.

Frequently Asked Questions about the Cash Envelope System

Can I use the cash envelope system if I don’t use cash often?

Yes! Many people adapt the system by using digital “envelopes” with budgeting apps or spreadsheets. The key is to keep spending within your pre-set limits for each category.

What if I run out of money in an envelope?

If you run out of cash in a particular envelope, you should stop spending in that category until your next budgeting period. This is how the system helps you avoid overspending.

Is the envelope system safe?

While carrying cash comes with some risks, you can minimize them by only taking what you need for the day and storing the rest securely at home.

How do I handle bills that can’t be paid with cash?

For fixed expenses like rent or utilities, continue paying electronically. Use the cash envelope system for variable, discretionary expenses where overspending is more likely.

Can the envelope system help me save money?

Absolutely! By limiting spending and increasing awareness, many people find they have extra cash left over at the end of the month. This surplus can be added to savings or used to pay off debt.

Real-Life Success Stories with the Envelope Cash System

Many individuals and families have transformed their finances using the cash envelope method. Here are a few inspiring examples:

- Emily, a young professional: After struggling with credit card debt, Emily switched to cash envelopes. Within a year, she paid off $5,000 in debt and built a $2,000 emergency fund.

- The Johnson family: With three kids and a tight budget, the Johnsons used the envelope system to reduce grocery spending and save for a family vacation, all without accruing new debt.

- Mark, a retiree: On a fixed income, Mark found the envelope system helped him control discretionary spending and enjoy retirement without financial stress.

Conclusion: Is the Cash Envelope System Right for You?

The cash envelope system is a proven, powerful tool for budgeting and saving money effectively. By making your spending tangible and setting clear boundaries, it helps you develop better financial habits, reduce debt, and achieve your goals.

While it may take some adjustment—especially if you’re used to swiping cards or using apps—the benefits are well worth the effort. Whether you’re looking to get out of debt, save for a big purchase, or simply gain control over your finances, the envelope budgeting method can set you on the path to success.

Remember, the most important step is to get started. Try the cash envelope system for a month and see how it works for you. With patience and persistence, you’ll discover just how effective this classic budgeting tool can be.